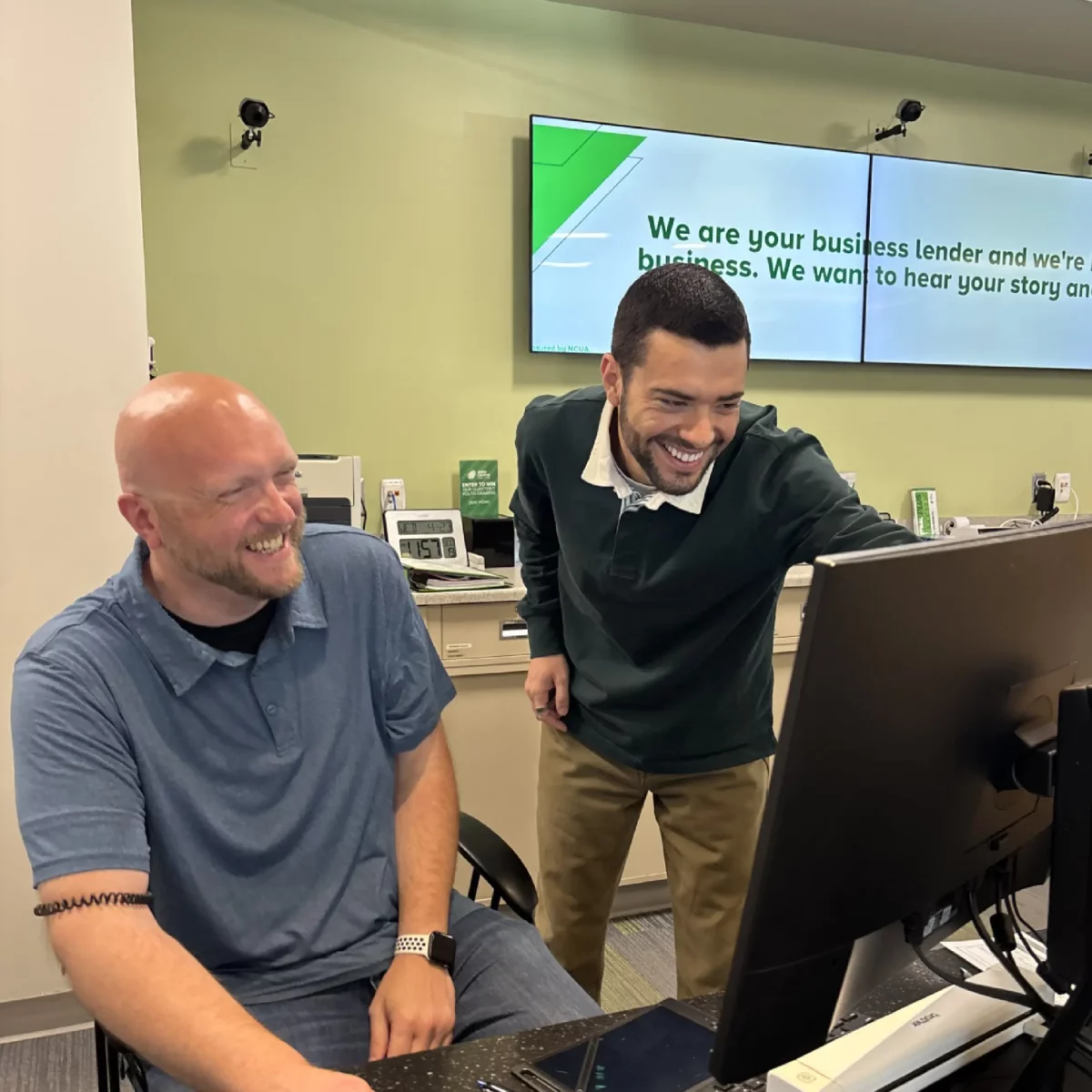

Here at ICCU, we’re not just fans of finance how-to’s and budgeting quick tips; we’re also suckers for good news. Throughout April, we gathered financial success stories in honor of Financial Literacy Month, and we stumbled on one that’s been right under our noses — at an ICCU branch.

Meet Darian

Like most high school students, Darian Miles didn’t spend his days dreaming of a career in banking. In fact, he didn’t know anything about financial literacy until his cousin convinced him to apply for an internship at ICCU’s student-run branch.

What seemed like a small choice at the time morphed into one of the most pivotal decisions of his life, leading him to a career of leadership, financial mentorship, and community impact.

What is a Student-Run Branch?

Back in 2007, we pioneered our first student-run branch at Mountain View High School, the very school where Darian attended. It was designed to give students and faculty access to everyday banking services, improve financial literacy, and provide real-world job experiences before they entered the workforce and college.

“I just remember being pulled into it,” Darian reminisced. “My very first job interview was with ICCU. It felt safe because it was all within the school.”

Students work in the school branch during a class period to earn an elective credit, then contribute a few hours after school in a full-service branch for pay. For these high school students, ICCU is often their first introduction to both the professional world and the world of finance.

ICCU currently operates branches within three Idaho high schools: Mountain View High School in Meridian, Owyhee High School in Meridian, and Thunder Ridge High School in Idaho Falls.

From a Part-Time Job to a Career

On the job, Darian was immersed in professional responsibilities and expectations. He worked with an established branch manager to help others with basic transactions like opening accounts and assisting members with loans.

“It was knowledge through a fire hose. I learned everything – what it meant to work, be responsible, and manage my own accounts.”

After high school, Darian continued with ICCU as a teller but quickly progressed into leadership roles. ICCU has seen great strides with teenagers in these student-run branches, and many are hired as full-time employees after completing their internship, providing them with further experience and opportunities as they grow into adulthood.

As Darian grew, so did his path within the credit union. He worked at multiple branches, first as a Member Service Specialist, then as a Financial Services Officer. He explored community-based roles as a Community Development Officer and then as part of the Dealer Relations team.

In 2019, he found his perfect fit and has worked in branch management ever since.

“I’ve always felt taken care of,” Darian said. “The support from ICCU made all the difference.”

From Learning Financial Literacy to Teaching It

In the early stages of his career at ICCU, Darian read The 8 Pillars of Financial Greatness by Brian Nelson Ford and worked through the accompanying workbook. As he met with his manager to discuss what he was learning, he moved beyond the basics of budgeting and into long-term financial strategies.

“ICCU has created this safety net. It has made me feel invested in and like I matter. … We’d meet one-on-one with our manager, set financial goals and work through the steps. It helped me understand long-term decisions like buying a house and how to prepare.”

Today, Darian is paying it forward by mentoring high school interns in his own branch. He has mentored seven to eight interns and delights at the opportunity to teach them what he learned in the very same program years ago.

“We work with them, not over them,” he said. “I treat them like regular team members with the same respect and the same expectations. I’m often impressed by their performance.”

Darian works with each student one-on-one to explore their money questions, goals, and financial literacy skills. He recalls working through a goal sheet with a former intern who was convinced the sheet didn’t apply to her.

“She told me, ‘These questions don’t even apply to me.’ But we went through them anyway.”

During their conversation, he discovered that she hoped to graduate college without any student debt but was unsure how to do it. Together, they created a strategy to reach that goal. He helped her set up a savings account that she couldn’t easily abuse, encouraged budgeting, and created a college financial plan.”

“She came back this last Christmas and told me she didn’t have any debt,” he beamed. “That was the goal, and she has stuck to it.”

A Vision for the Future of Financial Literacy

Darian is hopeful about the progress schools have made with financial education. In recent years, Idaho has even passed a law that requires personal finance credit in high schools, which prepares students for the real-world decisions that await them after graduation.

“I think it’s going in the right direction, he said. There’s more emphasis on those topics in schools. That stuff is important to know, and not just to get through life but to get through it well and comfortably, and to feel good about where you’re at financially.”

When asked what advice Darian would give to a high school student on the brink of entering the adult world, his answer was simple: “It’s okay not to know. Don’t be afraid to ask questions or start something new. Don’t worry about looking dumb. Come see us. We want to help you figure it out.”

Darian is spot on. If you’re ready to take the leap like he did and become more financially literate, we’re here to help. Browse through our Financial Wellness Center to find tools and resources that will take your money strategy to the next level.