Think fast: What’s your current credit score?

If you don’t know the answer off the top of your head, you’re not alone. According to a recent study, more than 35 percent of Americans don’t. In fact, only 2 of every 5 people can confidently report that they have the credit score necessary to successfully achieve their financial goals.

But see, that presents a problem for ICCU. Here at ICCU, our mission is to help our members achieve financial success — and we can’t do that if you don’t have the right tools or know-how. That’s why we’ve assembled resources that will help you with not only credit, but every stage of your financial journey.

Here are three FREE personal finance tools we’ve made exclusively for you, our members.

Get Quick Finance Lessons with MoneyEdu

If you’ve ever thought to yourself, “Why didn’t they teach me about personal finances in school?” then you’re in luck. We’ve partnered with MoneyEdu to do just that.

MoneyEdu is a free program (to ICCU members) that can help you …

- Measure your financial health

- Get an overview of financial basics, then dive deep into your favorite courses

- Access tools like budget calculators and checklists

- Develop a monthly spending plan

- Calculate the costs of large purchases

- Create milestones to celebrate your achievements

MoneyEdu courses will walk you through must-know topics in today’s world — how to avoid financial scams, use a credit card wisely, manage your credit score, and everything in between.

How to find it: You can access MoneyEdu here or by visiting iccu.com. In the sites main navigation window, click Services > Financial Wellness Center > MoneyEdu.

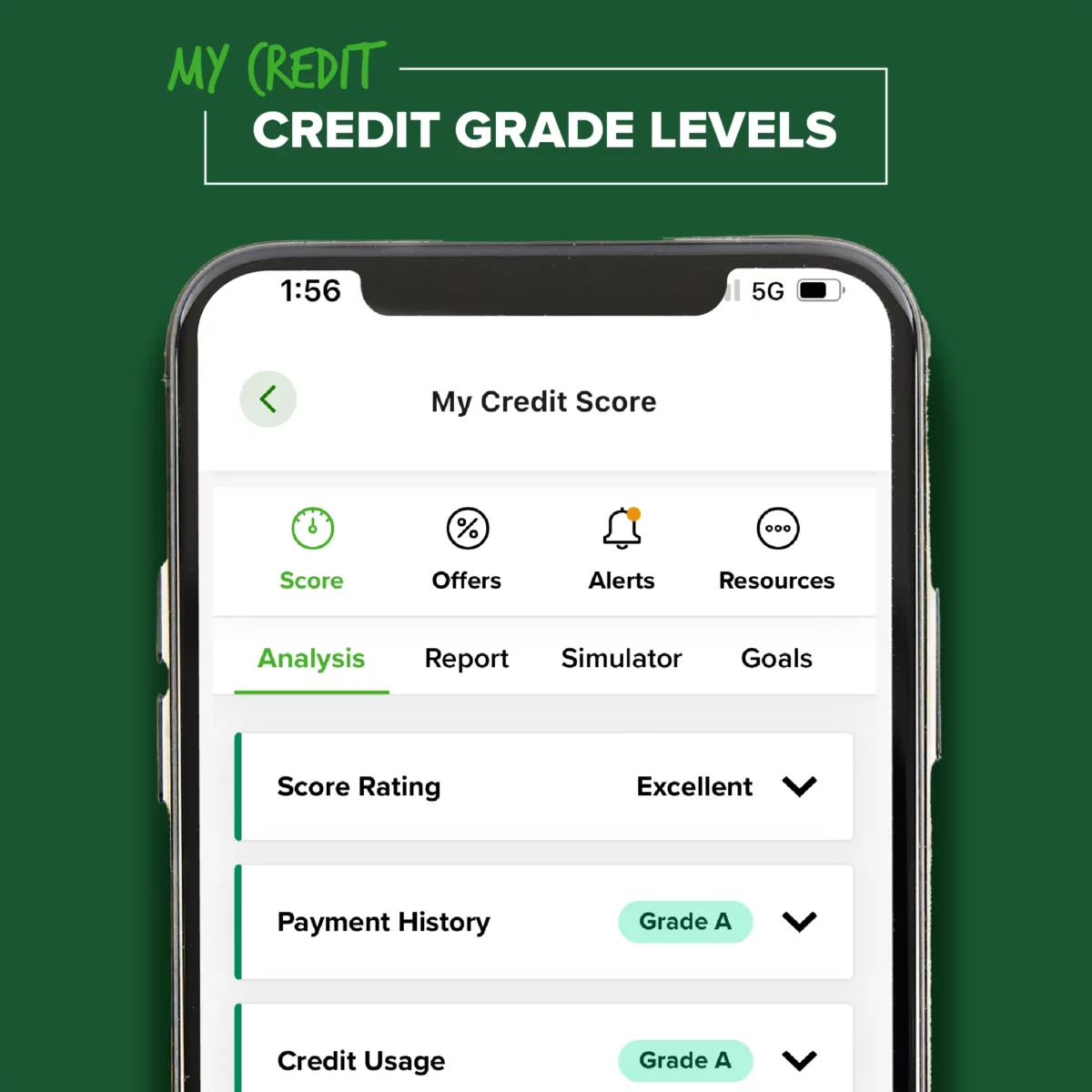

See Your Credit Report with My Credit

My Credit gives you the ability to check your credit report daily — with no impact to your credit score. It can notify you when your score changes, help you predict your score in the future, and show you personalized offers.

How to find it: If you’re a member at ICCU, all these capabilities and more are in your eBranch Online Banking or Mobile App. Once you open the app, you can locate it by clicking More (mobile) > Planning and Offers > My Credit.

Score Analysis and Credit Report

If you’re the kind of person who likes to stay on top of your credit, these features are for you. Score Analysis shows you each puzzle piece of your credit score (credit usage, inquiries, account mix, etc.) and ranks them with a letter grade. That way, you can tell which pieces you need to improve with a quick glance. The Credit Report option reports similar information but in much more depth. This is where you’ll find a full list of your accounts, inquiries, collections, and more.

Got loans? The Credit Report will show you your current balance and how much you’ve paid off. Got credit cards? It will show you the percentage of credit you’ve used for each card. (Tip: Stay below 30% credit utilization for a better credit score!)

Score Simulator

If one of your New Year’s goals is to improve your credit score, you’re in luck. My Credit’s Score Simulator quickly shows you how to reach your dream credit. Or, if you’re thinking about making a decision that might affect your credit score, you can get a glimpse of how much it will improve or decrease your score.

Take Sadie*, for example. She has a 788 credit score and wants to see if it’s possible to reach 800 soon. With the Score Simulator, she finds that if she misses her monthly payments on all her accounts for one month, her score will drop to 685, a 103-point drop. If she pays off all her credit card balances, however, she realizes her score will raise to nearly 800, which most lenders consider ‘Excellent’.

*Sadie is a hypothetical character meant to demonstrate product features only. Results vary.

Track Your Progress with Financial Wellness

Expenditures. Bleh. The word can put you to sleep if you’re not careful. But businesses track their daily expenditures for a reason, and if you want to achieve financial stability, you may want to, too.

Fortunately, the Financial Wellness widget in eBranch is here to make even the most monotonous tasks quick and easy while still giving you a complete rundown of both your spending and savings goals.

How to find it: If you’re a member at ICCU, this finance tool and more are in your eBranch Online Banking or Mobile App. Once you open the app, you can locate it by clicking More (mobile) > Planning and Offers > Financial Wellness.

Spending

The Spending tab shows your monthly costs, transactions, and recurring expenses. It splits your payments into several categories so you can see what area is hurting your wallet the most.

Worried you spent too much eating out last month? We’ve been there. Look at the Categories section to see how much of your budget it’s eaten.

Not sure what subscriptions you’re paying for anymore? No worries. The Recurring Expenses section shows you exactly what you pay for month after month.

Savings Goals

This is where the Financial Wellness tool shines. The Savings Goals tab lets you set different savings goals for each savings account. Just set a due date and watch your goals progress the more you save. Voila!

What Are You Waiting For?

Three free personal finance tools are at your fingertips. As a member at ICCU, you get unlimited access to MoneyEdu, My Credit, Financial Wellness.

Not a member? Join today.