Branches

Both branch locations will close at the end of business day on Friday, August 29 and remain closed through Monday, September 1 in observance of Labor Day. During this period, the transition from TOPCU to ICCU will be completed. The branches will reopen on Tuesday, September 2. The current branch hours will remain the same.

Online & Mobile Banking

TOPCU’s online and mobile banking services will be turned off at the end of business on Friday, August 29. Once the conversion and maintenance are complete, you will access your accounts via ICCU’s eBranch Mobile and Online Banking. You will receive a letter in mid-August with additional account information and instructions for logging into ICCU’s eBranch for the first time. You may also click below, or contact us, for details.

Fees/Charges Comparison

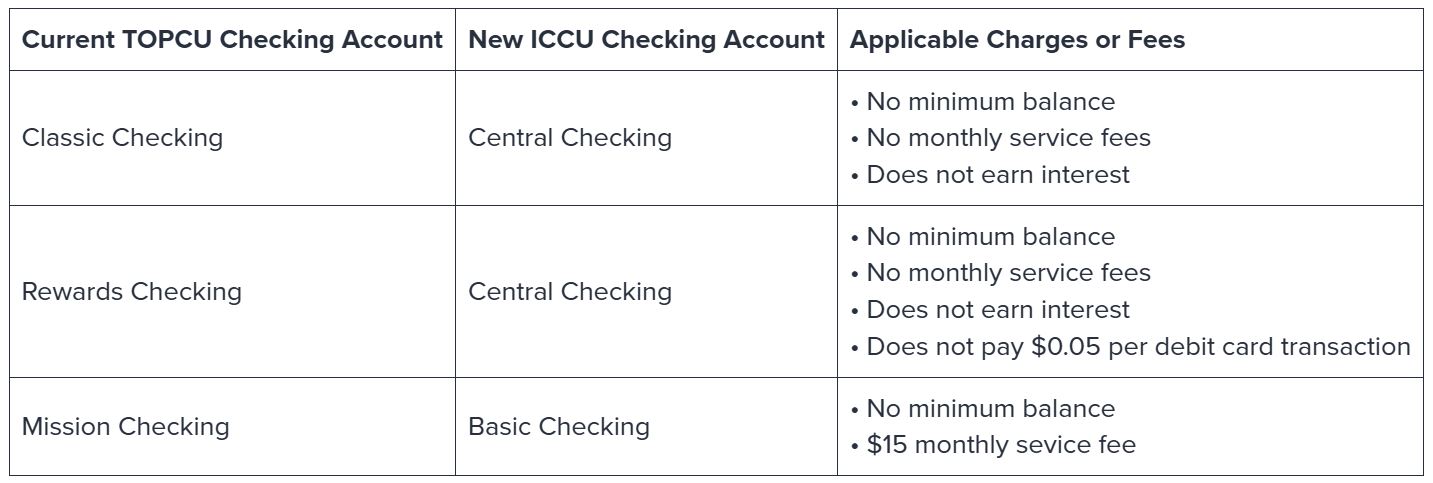

View a comparison of TOPCU’s and ICCU’s fees and charges.

To contact ICCU, call 1-800-456-5067, start a chat, video chat with a representative, or find our nearest branch locations.

Frequently Asked Questions

Membership

Who is ICCU?

Headquartered in Chubbuck, Idaho, ICCU was organized as a state-chartered credit union on June 28, 1940. ICCU currently serves over 700,000 members with more than 60 branches throughout Idaho, Washington, and Arizona. Our goal is to provide the personalized service our members deserve, with the products and services they need. Our mission is to help our members achieve financial success. ICCU is consistently ranked one of the top-performing credit unions in the country and named a Best Place to Work in Idaho and the Inland Northwest.

When will my account be switched to ICCU?

TOPCU will close its doors at the end of the business day on Friday, August 29, 2025. On Monday, September 1, 2025, you will be a member of ICCU. Branches will be closed through September 1, 2025, in observance of Labor Day and will reopen on Tuesday, September 2, 2025. We’re excited to serve you!

What is my new membership number and account numbers?

You will receive your new membership number and checking account numbers by mid-August.

What benefits are there to TOPCU members?

ICCU offers a full line of financial products for you, your family, and your business. In addition, we offer a variety of electronic services to save you time and money. Visit iccu.com to learn more.

Will my money still be insured?

Yes. Just as with TOPCU today, your accounts with ICCU will be federally insured by the NCUA, up to $250,000.

What is ICCU’s Routing Number?

324173626

Will joint owners of my TOPCU accounts automatically become joint owners on my ICCU accounts?

We are making every effort to transfer joint owners. However, due to the account conversion process, some joint owners may not automatically transfer to your new ICCU accounts. After the merger date, if your joint owners do not appear on your accounts, please visit your local branch or contact us via VideoChat to have them added.

If I have additional insurance coverage as part of my TOPCU membership, will it change?

Any TruStage insurance policies for Accidental Death and Dismemberment, Auto, Home, or Life Insurance obtained as part of your membership with TOPCU that are directly debited from your TOPCU account will be transitioned to your new ICCU account.

Will I need to set up automatic internal payments or transfers again?

Your existing automatic internal loan payments or transfers between accounts will be set up on your new ICCU accounts. If you would like to make any changes to these payments, please visit your nearest ICCU branch.

Who do I contact with questions?

We are here to answer any questions you have about your accounts or the transition from TOPCU to ICCU. Please read through this FAQs document. We also encourage you to stop by your nearest branch, video chat with us, or give us a call at 1-800-456-5067.

What is ICCU’s membership fee?

ICCU’s membership fee is $5. TOPCU members transferring to ICCU as part of the merger will not be charged this fee.

What if I already have accounts at ICCU?

Your TOPCU accounts will be moved over separately from any existing ICCU accounts. We don’t assume that you want them combined, however, if you want to combine them after the merger, you’re welcome to do so.

Does ICCU participate in the CO-OP Shared Branch services?

No, ICCU does not participate in CO-OP Shared Branch services. We invite you to use our VideoChat service and eBranch Online Banking to manage your financial needs from anywhere in the world.

Savings

Will there be any changes to my savings account(s)?

All TOPCU members are required to have an ICCU Share Savings Account. Either a Share Savings Account or a Business Share Savings Account is necessary to maintain ICCU membership. Dividends will begin accruing on your Share Savings Account or Business Share Savings Account with a balance of $300 or more. The current dividend rate is 0.15% APY* and is paid quarterly. For additional savings options, please visit iccu.com.

Does ICCU offer a High-Yield Savings?

Yes, our High-Yield Online Savings Account is an online-only product that pays a competitive variable rate for balances of $1,000 or more. If the daily balance falls below $1,000, a monthly service fee of $10 will be charged. If you currently have a TOPCU Rise High Yield Savings, your account will be converted to an ICCU High-Yield Online Savings Account. Please review the Membership & Account Agreement for more details.

Does ICCU offer a Money Market Savings?

Yes, our Money Market Savings Account pays a competitive variable rate for balances of $2,500 or more. If the daily balance falls below $2,500, a monthly service fee of $15 will be charged. If you currently have a TOPCU Money Market Savings, your account will be converted to an ICCU Money Market Savings Account. Please review the Membership & Account Agreement for more details.

What savings account options are available?

Secondary Savings, High-Yield Savings, Money Market Savings, Youth Savings Accounts, IRA Accounts, Business Secondary Savings, and more. To learn about each account, please visit iccu.com or the nearest ICCU branch.

What changes will be made to my Certificates of Deposit (CDs)?

There will be no changes to the following terms: APY, term, 10-day grace period, and early withdrawal penalties. The interest compounding period will be modified as follows. Please note that this change does not affect the account’s APY.

• Terms less than 12 months: Interest will be compounded and credited to the certificate account at maturity, becoming part of the principal balance.

• Terms 12 months or greater: Interest will be compounded and credited to the certificate account quarterly, becoming part of the principal balance.

Please review the Membership & Account Agreement for more details.

What Certificate of Deposit (CD) options are available?

ICCU offers CDs for terms ranging from 90 days to 5 years with a minimum deposit of $500. For additional details on CDs, please visit iccu.com or the nearest ICCU branch.

Will rates change?

The rates of TOPCU and ICCU were aligned prior to the operational merger. The variable APY* rates will be similar to the current ones but are subject to change at any time. CD rates are fixed and will remain for the remaining term of the account. *APY= Annual Percentage Yield. APY is subject to change at any time.

Checking

Will I need to set up my direct deposits coming into my checking account?

ICCU will set up your current direct deposits for you on your corresponding ICCU accounts and attempt to notify the company initiating the deposit of the change. If you have any questions, please give us a call at 1-800-456-5067.

Will there be any changes to my personal checking account(s)?

ICCU offers a variety of checking accounts to fit your needs including Central Checking and our premier checking product, Central Plus. All TOPCU personal checking accounts will be converted to our Central Checking, Basic Checking, or Starter Checking for members under 18. To learn more about the benefits of ICCU checking accounts, visit iccu.com.

To review the product disclosure for these accounts, please see the Membership & Account Agreement.

Will ICCU offer the TOPCU Rewards Checking Account?

No, ICCU does not offer a product like the Rewards Checking Account. However, we provide a premier checking account called Central Plus. The Central Plus Checking Account includes benefits such as Cell Phone Protection, Travel & Leisure Discounts, Debit Advantage, Health Discount Savings, Telehealth, Roadside Assistance, Identity Theft Services, and more. All current TOPCU Rewards Checking Accounts will be converted to our Central Checking Account, which has no minimum balance requirements or monthly service fees. You can upgrade to our Central Plus Checking by visiting a branch, through eBranch Online Banking, or by contacting us. All the Central Plus benefits are included for a low monthly fee of $7, and your first month is free! See special offer

What changes will be made to my business checking account(s)?

We offer business accounts for various business needs, along with comprehensive treasury management services. Your current accounts will be converted as follows. We highly recommend you review our business products and service offerings at www.iccu.com/business to determine how ICCU can best help your business succeed financially.

TOPCU Business Checking and Basic Business Checking will be converted to the ICCU Small Business Checking, with the applicable fees.*

• No monthly fee

• 200 free monthly transactions, $0.20 each additional

TOPCU Plus Business Checking will be converted to the ICCU Business Money Market Checking, with the applicable fees.*

• $10 monthly fee if daily balance is less than $2,500

• 300 free monthly transactions, $0.20 each additional

*Subject to other fees as defined in the ICCU Fees and Charges schedule.

Will the daily limits change on my debit or credit card?

Yes. Your new ICCU debit card will have a daily limit of $7,000. An ICCU credit card also has a daily limit of $7,000. The daily ICCU limit of cash withdrawal at an ATM is $710.

Will my TOPCU checks continue to work?

You may use your TOPCU checks through August 29, 2025. Beginning September 1, 2025, please begin using the ICCU provided checks. You may bring any unused TOPCU checks into your nearest ICCU branch to be shredded at no cost to you.

Will I receive new ICCU checks?

You will receive a page of starter checks by mid-August. If you would like to order checks, please visit a branch or contact us after Tuesday, September 2, 2025, to receive your first box of checks free of charge. Due to account conversions, if joint owners are not listed on your checks, please visit your nearest branch to have them added to the accounts.

Will my new checking account come with overdraft protection?

We will provide additional communication regarding the ICCU overdraft protection program in upcoming communications.

Will I need to update any external automatic payments (ACH) being withdrawn from my checking account?

We will attempt to process these withdrawal(s) from your new ICCU account and notify the company initiating the transaction of your new routing and account number at ICCU. We are unable to guarantee that updates will be made by those companies, and we encourage you to contact them directly to ensure they have your new routing and account number(s). If you have any questions, please give us a call at 1-800-456-5067.

Will I receive a new debit card(s)?

No, your current TOPCU debit card will continue working with your new ICCU checking account. Your current card will be automatically replaced before it expires, or you may visit your nearest ICCU branch to have a new one issued to you sooner.

Will my debit card PIN change?

No, the current PIN you have set on your TOPCU debit card will continue to work as it does today.

Is there a minimum balance or monthly fee for my ICCU checking account?

There is no minimum balance required, and there are no monthly fees for using your ICCU Central Checking Account. Please see the included fee comparison and additional comparison found on our website.

What if I see another checking account that I am interested in?

ICCU offers a variety of products to meet our members’ needs. If you are interested in a different checking account product, it is simple to switch, and we’d be happy to help you. Please stop by a branch or give us a call at 1-800-456-5067.

What ATM network does ICCU provide?

ICCU members have access to over 30,000 ATMs nationwide as part of the CO-OP ATM Network. AllPoint ATM surcharge free access will be available until December 31, 2025.

Will fees change?

Yes. For a complete list of ICCU’s fees and charges please see the Membership & Account Agreement. View a comparison of TOPCU’s and ICCU’s fees and charges..

Loans

What will happen to my loans at TOPCU?

All loans will be transferred to ICCU. You will have access to your loans on eBranch and will be able to make payments, ask questions, or get support by stopping by a branch or contacting us at 1-800-456-5067.

Will the terms and interest rate change?

No, your loan terms and interest rate will remain the same.

Will my payment or due date change?

The due date for your personal and home equity lines of credit will be changed to the 25th of each month and the 20th for all business lines of credit. All other loan payment schedules and due dates will remain unchanged.

How do I make a payment on my loans?

For your convenience, you will now make your payments to ICCU after the merger date of Monday, September 1, 2025. You may make payments online with eBranch, over the phone, or at your nearest branch location. Or if you prefer, you may mail your payment to ICCU at P.O. Box 2469, Pocatello, ID 83206. We can also help you set up automatic loan payments from your ICCU checking or savings account.

How will this affect my credit score?

We are working closely with the credit bureaus to correctly transfer all active loans to ICCU and minimize the impact on your credit score.

What if I have a mortgage loan through Centennial Lending?

If your mortgage is managed through Centennial Lending, there will be no changes. You will continue to make payments and address inquiries directly with them. Please be aware that your mortgage details, including the balance, will not be accessible via the ICCU eBranch. To verify your balance, make payments, or obtain other loan information, please contact Centennial Lending at 720-494-2740 or visit their website at www.centennial-lending.com.

Credit Cards

When will I receive my new credit card(s)?

You should receive your ICCU Visa credit card by mid-August. If you or a joint owner does not receive a card in the mail, please stop by the nearest ICCU branch to have one instantly issued to you on or after Tuesday, September 2, 2025, or you may call us at 1-800-456-5067 to have one mailed to you.

Will I need to activate my new credit card(s)?

Yes. When you receive your new ICCU credit card, there will be instructions enclosed to activate your new card.

When will my TOPCU credit card(s) be deactivated?

TOPCU credit cards will be deactivated on Wednesday, September 10, 2025. Be sure to give your updated card information to the merchants and service providers that charge your card regularly.

Will the rate on my ICCU Visa be different than my TOPCU Visa?

Existing credit card holders will receive a separate notice outlining any changes regarding your credit card account(s) in July. In the meantime, explore the benefits and rewards of our Visa credit cards at iccu.com.

How do I make a payment on my ICCU Visa?

For your convenience, you will now make your payments to ICCU. You may make payments online with eBranch, over the phone, or at your nearest ICCU branch. You may also mail your payment to ICCU, P.O. Box 2469, Pocatello, ID 83206.

When will my ICCU credit card payment be due?

Your payment will now be due on the 15th of each month.

Online Banking

When will I receive my online banking login?

You will receive a letter in mid-August with additional account information and instructions for logging into ICCU’s eBranch online and mobile banking for the first time. You may also contact ICCU for additional details at 1-800-456-5067.

Are there tutorials I can view?

Yes. eBranch tutorials are available at iccu.com/tutorials.

Is there an ICCU online banking app available for my smartphone?

Yes. ICCU offers apps for both Apple® and Android™ devices. To learn more, visit iccu.com.

How will I be able to access my TOPCU account history?

TOPCU account history will be available in TOPCU’s online banking system until the evening of Friday, August 29, 2025. Your account history will be transferred to ICCU and will be accessible on ICCU’s eBranch Online Banking starting Monday, September 1, 2025.

When will I stop accessing TOPCU online banking?

TOPCU online banking will be available until the evening of Friday, August 29, 2025. Following the account conversion, beginning Monday, September 1, 2025, you will access your account via ICCU’s eBranch online and mobile banking.

When will I stop accessing TOPCU online bill pay?

TOPCU’s online bill pay system will be available until the evening of Friday, August 29, 2025. If you have any online payments scheduled after this date, you will need to recreate these payments within ICCU’s online bill payment system.

Will I keep my Bill Pay payees?

Yes, existing payees will be transferred to ICCU’s eBranch. However, scheduled payments will not transfer and will need to be set up again.

Will I still receive my eBranch alerts and notifications?

No, any alerts and notifications set in eBranch will need to be set up again after the merger is complete.

Will I still be able to access Zelle?

Yes. However, you will need to re-register for Zelle after you log into ICCU’s eBranch mobile banking. All previous Zelle transaction history will be unavailable.

Will I still have access to my external-linked accounts?

Yes. Externally linked accounts within TOPCU’s online banking will transfer and be linked to your online banking with ICCU.

Others

What are the branch hours?

The branch hours will remain the same, Monday – Thursday 9:00 am – 5:00 pm and Fridays 9:00 am – 6:00 pm. The Main Branch is also open on Saturdays 9:00 am – 1:00 pm. To see a full schedule of all our branch and ATM locations, please visit iccu.com/locations.

VideoChat is available Monday – Saturday 8:00 am – 7:00 pm MT.

What holidays is ICCU closed?

New Years, Martin Luther King, Jr. Day, Presidents Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas.

When will I receive my account statements?

A final TOPCU account statement will be mailed to you after August 31, 2025. You may choose to receive your ICCU account statements by paper or eStatements. To update your delivery preference, log into eBranch Online Banking and select statement preferences, visit the nearest branch, or call us at 1-800-456-5067.

How can I contact ICCU?

Call: 1-800-456-5067

Click: Visit iccu.com to start a chat, video chat with a representative, or to find our nearest branch locations and ATMs

Visit: Find our nearest branch locations and ATMs at iccu.com

You may also send payments and mail to: ICCU, P.O. Box 2469, Pocatello, ID 83206