Written by an ICCU team member

At what age did you know what a good credit score was? For Kevin Sumter, Chief Revenue Officer at Stukent, it was around 25, when he tried to buy his first car. For me personally, it was at 20, when I started my first job in the finance industry — as a credit repair specialist.

Sounds a little backward, right? We both learned vital personal finance skills right when we were expected to put the knowledge to use. That’s like learning the Heimlich Maneuver as the person next to you chokes.

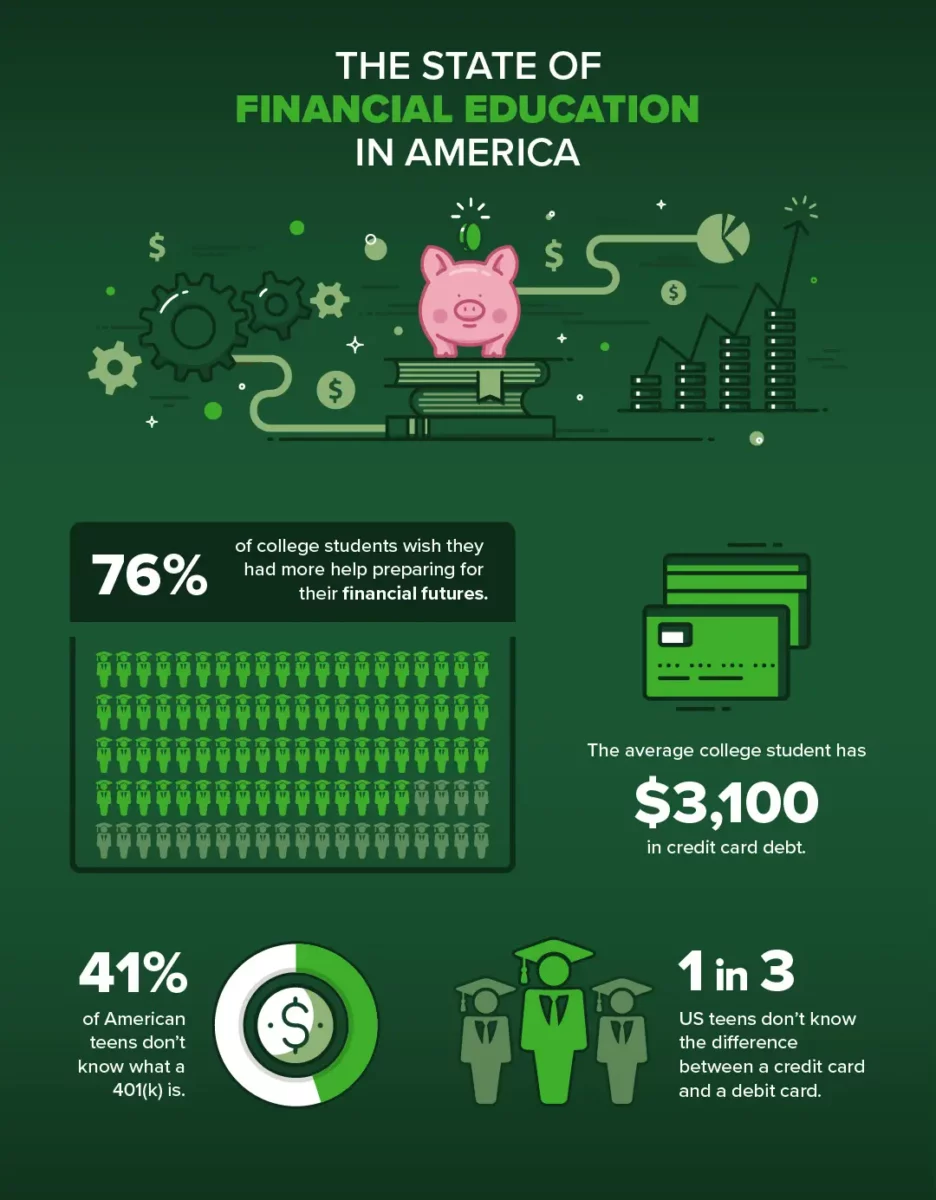

We’re not the only ones, either. According to the Financial Educators Council, 76 percent of college students wish they had more help preparing for their financial futures. Nearly half (41 percent) of US teens don’t know what a 401(k) is, and one in three don’t know the difference between a credit card and debit card.

But it doesn’t have to be that way.

Personal Finance Education Is Changing

Just a few months ago, Idaho legislators passed House Bill 92, which requires public high school students to take a personal finance class before they graduate. To count, the curriculum must teach students how to manage real-world finances — in other words, the skills we all wish we had learned in high school:

- Learn about different types of bank accounts

- Understand how to finance a college education

- Identify different types of credit and how credit scores are determined

- Compare investment options and calculate net worth

- Evaluate insurance types

- Understand the purpose behind tax regulations

- Build a budget for independent living

- Recognize the influence of money on human behavior

Read the full bill here. (Don’t worry, it’s only one page!)

This is a huge win for Idaho. While many schools offer personal finance classes, most states don’t require them to graduate. In fact, only 25 require an economics class at all. Every year, more and more studies show that financially literate youth are more likely to become financially stable adults. With House Bill 92 in place, Idaho teens will get the economic education they deserve.

Of course, this bill wasn’t passed overnight. Several high schools and credit unions (including ICCU) teamed up to show legislators how personal finance education can change youths’ lives. As a matter of fact, our CEO Brenda Worrell and CMO Michael Watson lobbied for this bill themselves.

Idaho’s Personal Finance Curriculum Needs an Upgrade

While House Bill 92 is a good place to start, settling for good enough isn’t exactly the ICCU way. In fact, the way we see it, the new legislation can only be really, truly impactful if teachers receive high-quality support and resources. And high quality isn’t exactly cheap.

When our children learn how to ride their bikes, it’s training wheels and helmets. When they learn to swim, it’s the shallow end and floaties. But when it comes to finances, we tend to push them in the proverbial deep end and hope they swim.

Brennan Summers, Director of Education Partnerships at Stukent

It’s no secret that US education budgets are stretched thin, so we teamed up with the digital courseware company Stukent to provide Idaho teachers and students with a simulation-based personal finance course. ICCU is covering the cost of this simulation (around $2.8 million total) for every high school in Idaho and eastern Washington.

(Has your school signed up? Check here.)

It’s a win-win situation. Teachers and students get the resources they deserve, and we at ICCU get to support two causes close to our hearts: northwest communities and financial education.

Of course, we’re not volunteering these funds on a whim. The truth is, we firmly believe that this course (combined with Bill 92) can completely reframe the way students approach personal finance — their interest in it, their knowledge of it, and how they apply it in their own lives.

In less than 3 years, 250+ schools have registered for the personal finance course and over 15,000 students have completed it, with overwhelmingly positive results.

But to understand the magnitude of that, you need to know what sets the Stukent courseware apart from other economics classes. The course, called Mimic Personal Finance (MPF), is centered around mimic software, which guides students through real-world finance scenarios.

How the Mimic Personal Finance Course Works

As Brennan Summers, the Director of Education Partnerships, says, “When our children learn how to ride their bikes, it’s training wheels and helmets. When they learn to swim, it’s the shallow end and floaties. But when it comes to finances, we tend to push them in the proverbial deep end and hope they swim.”

Mimic Personal Finance tackles that problem head-on. If you’re a high school student in Idaho or eastern Washington, you don’t have to learn complicated finance topics through a dry lecture. Instead of simply memorizing the formula for APR, you get to interact with APR the way you will as an adult by comparing loan options and paying down interest balances when they come due.

As a student, you get a simulated ICCU account. You’re paid a set amount biweekly, which you can use to purchase an array of perks: an extra bathroom pass, another day to take a quiz, a different seating assignment, you name it. But those purchases come with an implicit string attached – if you spend your money unwisely or too soon, you may struggle to fix a sudden flat tire or medical emergency that pops up later in the simulation.

[Mimic Personal Finance] is a trial run at adulting. A safe environment to practice, to succeed, and most importantly, to fail.

Brennan Summers, Director of Education Partnerships at Stukent

It may seem counterintuitive to provide students ample opportunities to fail, but in a way, that’s the beauty of MPF. They’re not just told how to avoid financial failures; they get to experience the inherent consequences of both good and bad financial choices. That way, they can make more informed decisions when they manage their own personal finances as adults.

The class covers everything from the stock market to student loans, health insurance to retirement plans. As they work through the course, students focus on building their credit scores and savings.

[With MPF, students] get real-life experiences without real-life consequences.

Laura Smith, VP of Community Development at Idaho Central

Every adult has lived the ups and downs of personal finance. We’ve all made the mistake of spending too much or too soon. But for students in Idaho and eastern Washington, it’s different. As they go through MPF, they’re bound to feel the frustration and stress of budgeting unwisely. They’re going to feel a stab of panic when they miss a payment and their credit score takes a hit. Yet it’s a fake credit score and a fake missed payment. At the end of the day, they’re getting a trial run at adulthood so they can experience real success when they eventually manage their own finances.

How to Get the MPF Course in Your School

As cliché as it sounds, big progress really does start with small changes. Here in the northwest, we believe in not only protecting our kids’ futures, but in cultivating better futures. House Bill 92 and MPF are a great start, but to maximize the good we can do, we need your help to spread the word.

Our goal is to register every eligible high school in that time so that as many teenagers as possible have access to this next-level resource.

How to Help: If you live in Idaho or eastern Washington and you don’t already have access to MPF, you still have time to register your school. Not a high school teacher or student? Share this article with someone who is! Every high school added is another victory for the things we really care about: our families, our kids, and our futures.

Primary Sources

Brown, Alexandra M., J. Michael Collins, Maximilian D. Schmeiser, and Carly Urban. 2014. “State Mandated Financial Education and the Credit Behavior of Young Adults.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2498087.

Carlin, Bruce Ian, and David T. Robinson. 2010. “What Does Financial Literacy Training Teach Us?” The Journal of Economic Education 43 (3): 235–47.

“Fast Facts: Student Debt.” 2023. NCES. National Center for Education Statistics. June 2023.

“Financial Capability in the United States.” FINRA Foundation – Education, July 2022.

Idaho Education Committee. 2023. H.R. 92. Vol. 33–1614.

Norvilitis, Jill M. and Linn, Braden K. (2021) “The Role of Student Debt and Debt Anxiety in College Student Financial Well-Being,” Journal of Student Financial Aid: Vol. 50 : Iss. 3 , Article 3.

Review of Consumer Credit – G.19. 2023. Board of Governors of the Federal Reserve System. Washington D.C.: The Federal Reserve.

Review of Survey of Consumer Finances (SFC). 2018. Board of Governors of the Federal Reserve System. Washington D.C.: The Federal Reserve.