It’s that time of year again — the time where you choose a slew of financial resolutions, keep them up for a few weeks … and inevitably drop them before March. Rinse and repeat.

If you’re ready to break the Resolution Cycle of Doom, you should know one key strategy for sticking to resolutions: Pick the easiest, least glamorous goals first. Then you can use that momentum to tackle bigger ones down the line.

Of course, that’s easier said than done. Use these simple (and impactful) resolutions to get started, and you’ll hit your money milestones before you know it!

1. Review Your Finances

The beginning of the year is ideal for taking stock of your finances. Find out what you’re spending and why, then plan what you’re going to change. That might sound simple enough, but don’t be fooled. Depending on how you do it, this one can be easy peasy or the most challenging of the four financial resolutions.

Why? Because of a principle called activation energy, or what famous life coach Mel Robbins calls The Five-Second Rule. It essentially says that the most difficult part of any task is the first few seconds because you spend the most energy at the beginning when you’re forcing yourself to start — whether that’s budgeting, going to the gym, or even getting out of bed early. “If you don’t marry [your goal] with an action in five seconds,” Robbins says, “you pull the emergency brake and kill the idea.”

If you’re confident that you can and will examine your spending at the beginning of the year, do it today. Now, if possible. If you can’t do that, set a reminder in your calendar. The important thing isn’t finding enough time; it’s starting now, no matter how small your first steps are.

If you don’t marry [your goal] with an action in five seconds, you pull the emergency brake and kill the idea.

Mel Robbins, bestselling author and life coach

Now the easy way: Use those five seconds of activation energy to get a financial review! Stop by your local branch or VideoChat with us now.

This strategy works for a few reasons:

- Getting advice from an FSO will give you the information, confidence, and momentum you need to start on other intimidating financial resolutions.

- Financial reviews are free, which means you won’t have to set yourself back to push your finances forward.

- Reviewing your finances with an FSO takes an hour or less in most cases, which is far less daunting than the hours you could spend on Excel by yourself.

2. Make Savings and Transfers Automatic

Automatic savings knocks two birds out with one stone. When your recurring transfers are set to move to savings automatically, you eliminate the possibility of human error. Computers, as finicky as they can be, won’t forget to move part of your paycheck to savings.

In the finance industry, we call this paying yourself first. When you get paid, schedule a part of your paycheck to transfer into savings, then pay your bills. The rest of the check is yours to spend guiltlessly, however you see fit. It’s much less stressful than hoping you’ll have enough for savings by the end of the pay period, trust us.

Automatic savings also helps you instill discipline into financial resolutions by treating savings as a non-negotiable expense. This mindset helps you build your emergency fund and reach other goals more efficiently, fostering a habit of regular saving without relying on manual effort.

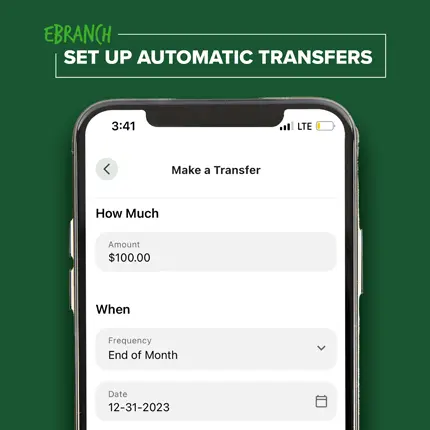

How to Set Up Automatic Transfers in eBranch

Simply click “Transfers” under the “Transfers & Pay” menu. It’s that easy!

3. Create or Optimize Your Emergency Savings

While it may or may not be possible to fill your emergency savings at the beginning of the year, you can optimize your savings account so that it can tick off your financial resolutions for you. Beyond automated transfers, your emergency savings (whether existent or not) can benefit from two other strategies: concealing specific accounts and choosing the right type of savings account.

Hide Savings Accounts from Your eBranch Accounts Page

The ideal emergency savings strategy gives you immediate access to your funds while simultaneously encouraging you not to use them. When you hide your savings account from your main eBranch Online Banking screen, you can still automatically deposit money, but you’re less likely to use it as a back-up checking account.

To hide an account, navigate to the Tools and Services menu on your phone or desktop. Click Settings > Accounts, then click the eye icon next to the account you’d like to hide. Follow the same steps to make the account visible again.

Choose the Right Savings Account

Not all accounts look alike. In fact, ICCU offers over a dozen savings accounts, all with their own advantages. When it comes to choosing the right savings account for your situation, it’s important to weigh their features against your goals.

Central Cents Savings Account

Central Cents is perfect for those who want saving to be as painless as possible. When you open a Central Cents Savings Account, your ICCU debit card purchases are automatically rounded up to the next whole dollar amount and deposited into your savings.

Central Cents Features

- Automatic savings (no setup required)

- Unlimited deposits

- Six free withdrawals every month

- No monthly service fee

High-Yield Online Savings Account

A High-Yield Online Savings Account (HYOSA) can be a great option for those who want to earn interest without decreasing their monthly withdrawals:

HYOSA Features

- Managed entirely online

- Earns a better interest rate than standard savings accounts

- Six free withdrawals every month

- $1,000 to open an account

- $10 monthly service fee if the balance goes below $1,000

Choice Savings Account

A Choice Savings Account allows you to save for a specific purpose and limits your withdrawals so you’re not tempted to dip into your savings.

Choice Savings Features

- Unlimited deposits

- Two free withdrawals per calendar year

- $25 minimum balance to open

- No monthly service fee

4. Keep an Eye on Your Credit

Most people know that a high credit score can earn you better loan approvals and interest rates, but monitoring your credit has plenty of other benefits:

- Identity Theft Protection: Monitoring your credit report helps you notice any suspicious activity on unauthorized accounts. In a digital world full of increasing cyberattacks, early detection of identity theft is crucial.

- Credit Report Accuracy: Errors on credit reports happen more often than you may think and can negatively affect your score. By keeping an eye on your credit report, you prepare yourself to spot inaccuracies and dispute them, ensuring your credit information is correct.

- Prevention of Financial Surprises: Monitoring your credit helps you anticipate potential challenges in securing credit. It lets you address the issues proactively — by paying down debts or resolving outstanding payments before you need credit, you improve your chances of getting a better loan approval or rate.

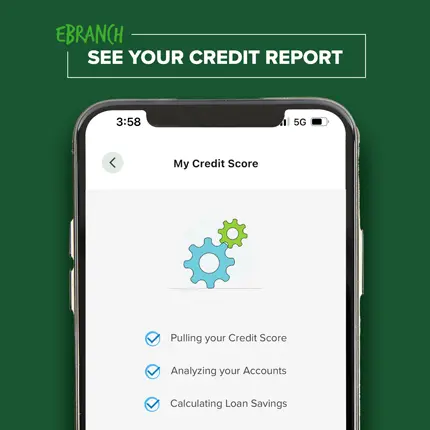

If you’re an ICCU member, you have FREE access to your credit report. To activate this service, simply click My Credit in mobile or online banking. Once you do, a credit widget will appear below your accounts so you can check your score as easily as you check your balances.

The Bottom Line on Financial Resolutions

Truth be told, it doesn’t really matter which financial resolution you choose. So long as you pick a small goal you can easily achieve, you’re setting yourself up for success. Feel free to start with one of the goals above and customize it to better fit your lifestyle. Not sure where to start? Click the button below to find your nearest branch and get a financial review today, or VideoChat with us from the comfort of wherever you are.