Imagine this:

One day, you go to your neighbor’s home to drop off some homemade bread. She’s an older woman, and when you arrive, you notice her usually pristine home is a little unkempt, and she seems more withdrawn than normal. Her usual happy demeanor is gone, and your attempts to talk to her seem to go unmet. You notice on the table a stack of letters, one near the top that is clearly a collections notice. You’ve lived by her for a while, though, and this doesn’t seem to match up. Her daughter, and caretaker, comes home shortly after, and the feeling in the room is tense. Your neighbor withdraws a little more, and you decide that maybe it’s time to go home. They clearly have some things to work out, and it’s better if you leave them alone to do it. It’s not your place. Right?

But maybe it is your place.

Let’s talk about Elder Abuse, particularly Elder Financial Abuse.

Though not a commonly talked about subject, it is sadly commonly occurring. The NCOA (Nation Council on Aging) estimates that approximately 1 in 10 Americans aged 60+ have experienced some form of Elder Abuse, and one study estimates that only 1 in 14 cases of abuse are reported to the authorities.

So what exactly is it?

Elder Abuse can take many forms, but the top 6 forms of Elder Abuse are physical abuse, emotional abuse, sexual abuse, exploitation, neglect, and abandonment.

Let’s focus in on the financial side of it.

Financial abuse is best seen in sudden changes in the person’s financial situation. Refer back to our previous example, how does someone you have lived near for years, someone you have always known to be very financially responsible, suddenly have a collections notice laying out? Many things may have caused this change in their financial situation, but paired with the strange interaction, state of her home, and tension with her caretaker, this should raise some concerns.

Unfortunately, it isn’t always so visible, and can range from the simple mismanagement of the older person’s funds, to being denied access to the funds completely. This can also take the form of theft, fraud, forgery, identity theft, and street and internet scams. The list of potential abusers is also long, including family, caretakers, neighbors, professionals, and con artists.

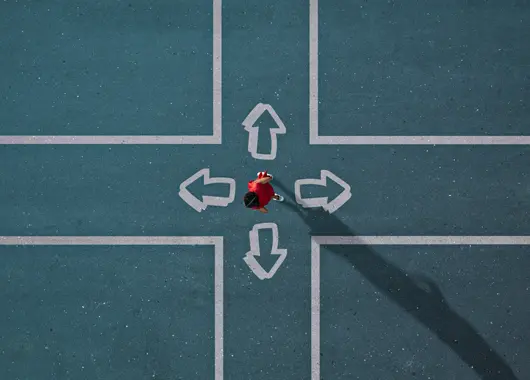

So how can I help prevent this?

First, be aware of the threat, and know the signs. Be on the lookout for any signs of physical abuse (bruises, marks, refusal to seek medical help for injuries, weight loss, lack of basic hygiene), emotional abuse (changes in behavior, unresponsive, suspicious or fearful, loss of interest, isolation), and financial abuse (unusual financial activity, strange signature on checks, life circumstances don’t match with his or her financial assets).

To stay on the lookout for these, keep in contact with the elders in your life. Building and maintaining a relationship with them will allow you to notice if things change, and will help them to trust and feel comfortable enough to ask for help when needed. Remember to also inform them of any scams you may be aware of. Keeping them informed on best practices to keep their identity and money safe can help prevent this abuse from occurring.

How do I protect myself?

There are many simple but effective way to take your care into your own hands whenever possible. Stay educated on any scams, and what to look out for. Remember to check your accounts regularly, even if your son, daughter, or caretaker is handling your finances for you.

Open your own mail, so you are always first to receive any communication about your accounts or bills that you may need to know. Don’t hesitate to contact your financial institution; they can help you identify any scams or fraud, and help you with the next steps needed to protect yourself. Just adding these simple tasks to your life may help you prevent unforeseen loss.

What do I do if I think this may be occurring?

Don’t ignore it; there are resources for you. Contact your state’s Adult Protect Services agency, or the Eldercare Locator hotline at 1-800-677-1116. They can help walk you through the entire process, and coordinate efforts with social services, law enforcement, and other agencies to investigate the allegation. Reporting abuse can be intimidating and uncomfortable, but if you suspect abuse, contact them as soon as possible.

Where can I find information?

Great question! Below are a list of some great resources to learn more about Elder Abuse, and how you can help prevent it.

https://www.moneycrashers.com/identify-elder-financial-abuse/

https://www.ncoa.org/public-policy-action/elder-justice/elder-abuse-facts/

https://www.ncoa.org/economic-security/money-management/scams-security/protection-from-scams/