Credit unions and banks are sisters, not twins. That’s a good thing. They share the same DNA, but each has unique and undeniable perks that help you customize your banking experience.

To take full advantage of those perks, you need to know the difference between the two. Though we may be a tad biased (#teamcreditunion), we believe everyone should have the info they need to be financially confident, regardless of where they bank. So without further ado, here’s what you need to know before choosing a financial institution.

The #1 Difference between Credit Unions and Banks

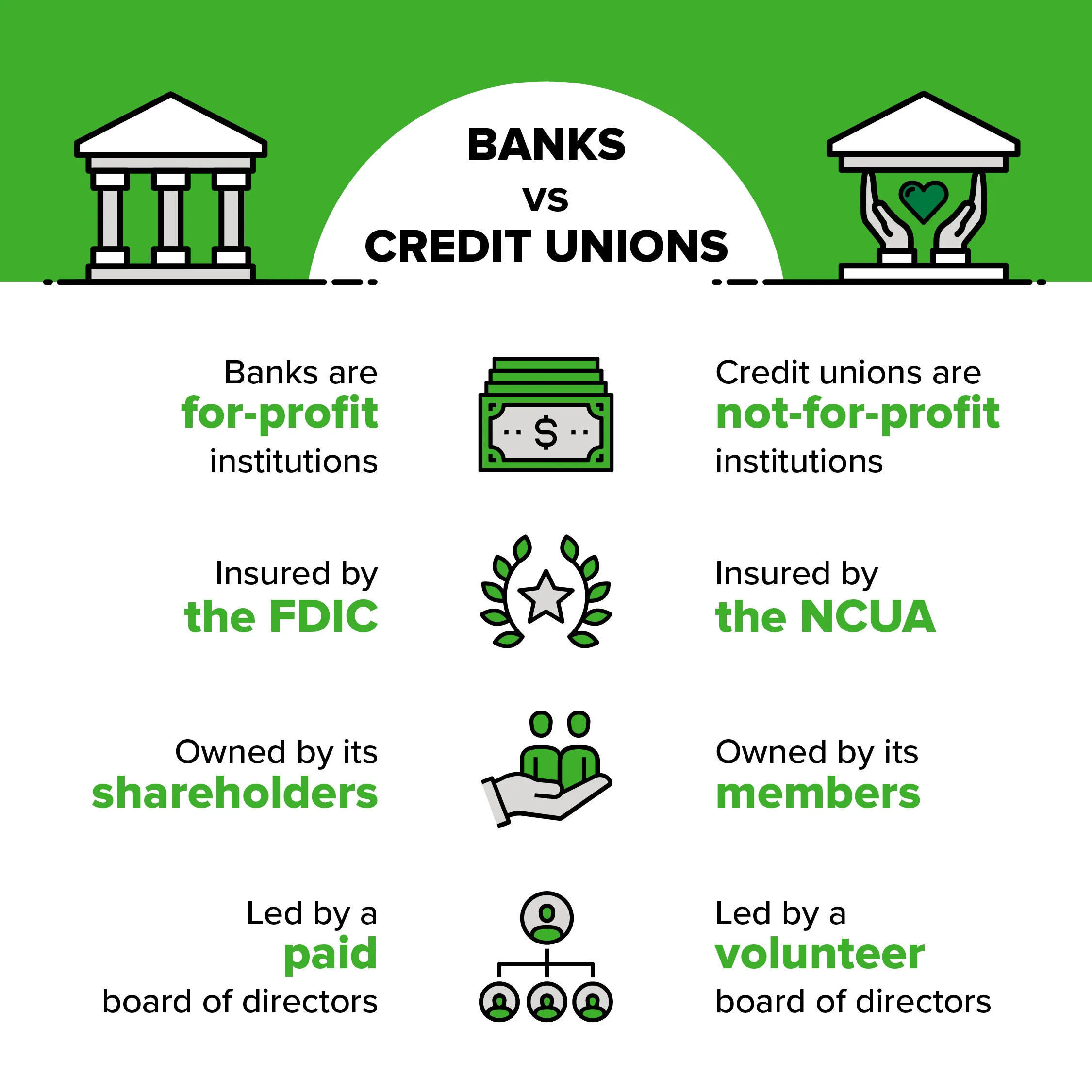

There are a few things that set credit unions and banks apart, but most of them stem from one main difference: Credit unions like ICCU operate as a not-for-profit, and banks operate under a for-profit business model.

As not-for-profit organizations, credit unions are responsible for returning value to their members. They don’t distribute profits to shareholders; instead, they invest the profits back into the credit union to advance the organization’s mission, which in our case is “Helping members achieve financial success.” Any surplus is typically returned to members in the form of lower fees, better interest rates, or improved services.

As for-profit organizations, banks are responsible for generating profit for its owners or shareholders. Unlike nonprofits and not-for-profits, banks are driven by one overarching objective — maximizing shareholder value and returning dividends to their investors.

Other than Profits, are Credit Unions and Banks the Same?

Not-for-profit vs. for-profit banking may not seem like a crazy difference, but just like genetics in siblings, a slight variation can lead to polarities down the road.

Structure

Credit Unions: Credit unions use a bottom-up decision framework. Each member has an equal vote in the credit union’s decisions, regardless of the amount of money they have deposited. Members are represented by a volunteer board of directors, usually composed of credit union members.

Banks: Because banks are owned by shareholders who expect a return on their investments, they typically use a top-down approach, leaving large-scale decisions up to the shareholders themselves.

Access and Branch Network

Credit Unions: Credit unions may have a more limited branch and ATM network, especially if they are community-based. However, many credit unions participate in shared branching networks and provide mobile banking, allowing members to access services from further away.

Banks: Banks typically have a larger branch and ATM network, especially if they are national or international institutions.

Interest Rates, Fees, and Services

Credit Unions: Credit unions often offer lower fees and more competitive interest rates on loans and savings accounts, as their goal is to benefit their members rather than generate profits.

Banks: Banks may have higher fees and interest rates on loans and credit cards, as they aim to maximize profits for shareholders. Because of this, they’re often able to provide services some credit unions cannot because they have access to shareholder funding.

Membership Eligibility

Banks: Banks are generally open to the public, and anyone can open an account or use their services.

Credit Unions: Credit unions have membership criteria, often based on a common bond such as living in a specific community, working for the same employer, or belonging to a certain organization.

Regulation

Credit Unions: Credit unions are regulated by the National Credit Union Administration (NCUA) at the federal level and may also be subject to state regulations.

Banks: Banks are regulated by federal and state banking authorities, such as the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

Should I Bank with a Credit Union?

As with most banking questions, the answer to the dilemma of credit unions vs banks depends on who you are and what you expect from your financial institution:

Typical Advantages of Credit Unions

- Better customer service

- Better interest rates and fees

- Owned by its members

- Representation through a board of volunteers

Typical Advantages of Banks

- Widespread accessibility

- More variety in products and services

- May be easier to bank internationally

- No membership requirements to join

While we obviously stand behind the strengths of credit unions, we suggest that you take the time to think about what banking features you rely on most before deciding where to bank.

We love being a credit union because of what it means to our members, our communities, and the Pacific Northwest. As a larger credit union, we’re positioned to give members a variety of services without sacrificing that small-town customer service we’re known for. That’s our sweet spot, our happy place — finding a way to give our members the best possible chance to reach financial success, regardless of how or where we grow.

No matter where you bank, we hope you find an institution that makes you feel the same.

Psst … Interested in becoming a member of ICCU? See if you’re eligible to join by clicking the button below.