Using credit to obtain things — whether new kitchen cabinets, an SUV or just coffee — is so common in America that many people constantly juggle several debts. Each month, consumers must make payments on their credit cards, auto loans, mortgages and more.

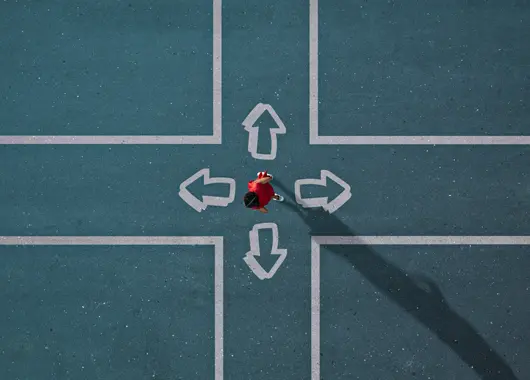

To maintain your financial health, it’s important to create a plan for paying down your debts strategically.

Determine what you owe

Make a list of all your debts, including the balance, monthly payments and interest rates. Some debts are considered “good,” such as the mortgage that finances your home, which has the potential to increase in value. Others are comparatively “bad,” such as high-interest-rate credit card balances and payday loans. Add up the minimums due each month.

Figure out what you can afford

Develop a simple budget by listing all sources of income, such as salary, child-support payments and freelance wages. Then, list fixed expenses such as rent or mortgage payments, child-care fees, utilities and car payments. Estimate your variable expenses, such as groceries and clothing.

Take a hard look at what’s coming in and what’s going out. Can you meet the minimum payments? Can you pay more?

Set priorities

Stay in good standing on your debts by paying at least the minimum due each month, to avoid late fees or an interest rate increase. If you can pay more than the minimum, focus first on debt with the highest interest rate. Once you pay that off, move on to the one with the second-highest rate and so on.

Meet with creditors

Sometimes creditors would rather cut you a break than risk seeing you default on a loan. If you have a large credit card balance with a double-digit interest rate that seems to be growing faster than you can pay it down, call the issuer and explain your difficulties. Try to get a lower rate, a temporary deferral or other modification.

If you’re struggling to pay your mortgage, call your lender right away to avoid penalties and to develop a plan. Some financial institutions, including Idaho Central Credit Union, have experts on staff that will help come up with one that works for you.

Transfer balances

If your credit is reasonably good, see whether you can transfer the balance from a high-interest-rate card to one with a lower rate. Doing so could buy you some time to pay it off.

Consolidate your debts

Another option is loan consolidation, or taking out a new loan to pay off several smaller debts, resulting in new borrowing terms and a single monthly payment. Some consumers can lower their costs by consolidating debt using a home equity loan. Such a loan requires putting up your home as collateral, which means you’re exposed to potential foreclosure if you fail to repay the debt.

Having a plan helps you stay focused on systematically paying down your debts, bringing you closer to the liberating experience of becoming free of debt — and stress.

Jeanne Lee, NerdWallet

© Copyright 2016 NerdWallet, Inc. All Rights Reserved