In one way or another, we’re all chasing the American Dream. Not the white picket fence per se, but the sense of security that comes with it. You know, the relief of paying your bills on time. The pride that comes with covering your kids’ tuition. The satisfaction of owning a home you love.

That’s the American Dream. And it’s expensive.

The good news is you may have more buying power than you think. With a Home Equity Line of Credit (HELOC), you can borrow against your home’s equity to access extra funds, often tens of thousands of dollars.

You can bet that kind of power can lead you closer to your own American Dream … or further from it. We’re here to show you what to expect when you take out a HELOC and how to sidestep the most common pitfalls. That way, you can feel confident wielding a HELOC before you even get one.

(Psst … Not sure if a HELOC is right for you? Check out our other credit lines and loans.)

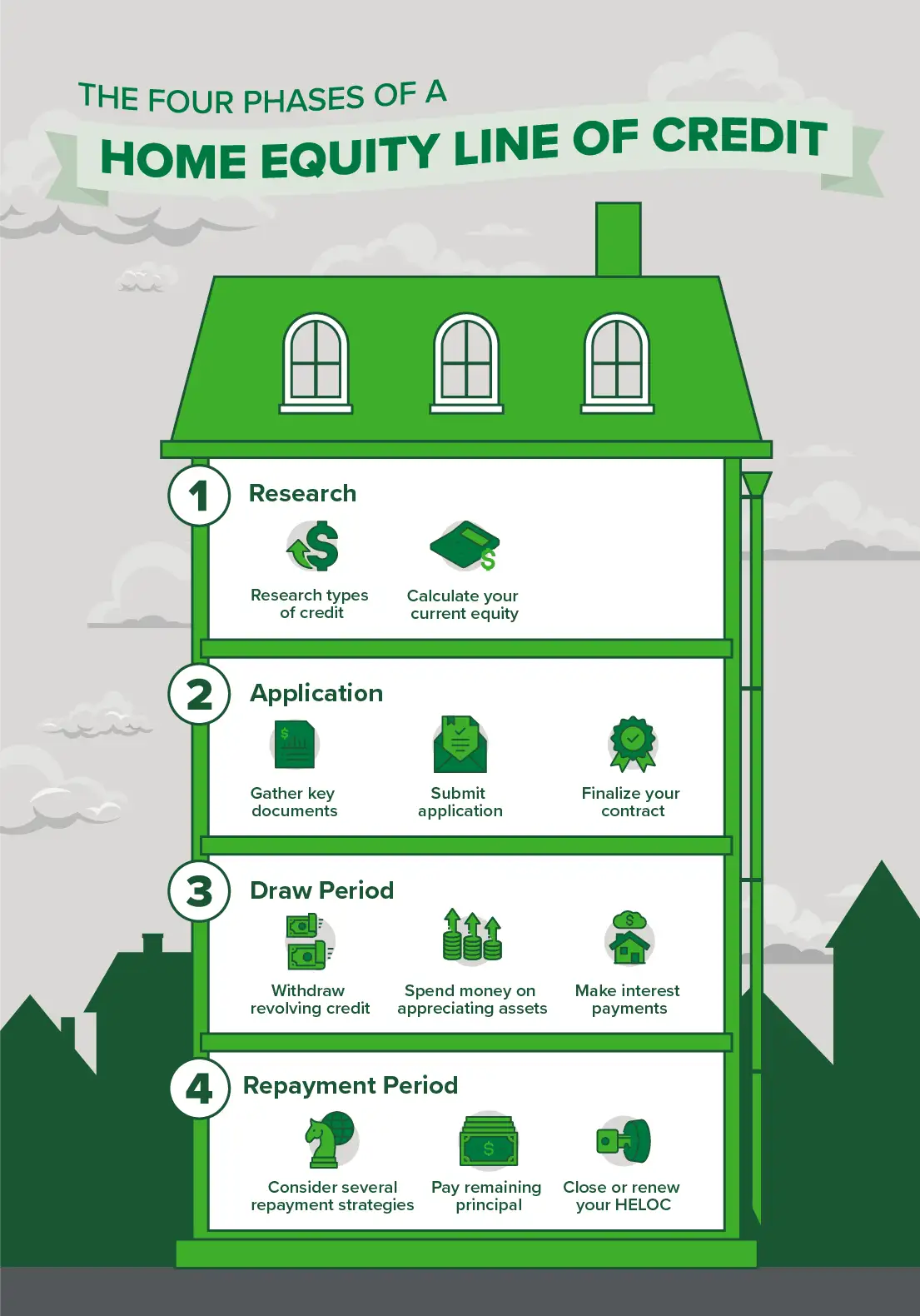

HELOCs At a Glance

A HELOC is a revolving line of credit that generally has a lower interest rate than other loans because it uses your house as collateral.

A HELOC is often used for home renovations, emergency funds, and other big purchases.

You can withdraw money from a HELOC in the draw period, which lasts about 10 years.* You make interest-only payments (at the minimum) during this time, too.

You must repay your remaining balance in the repayment period, which directly follows the draw period. If you made only interest-based payments during the draw period, you’ll pay the entire principal in the repayment period.

You can’t sell your home until your HELOC is paid off, so it’s wise to always have a repayment plan (or two) in hand.

What Is a HELOC and How Does It Work?

We could give you a dictionary definition but so can, well, a dictionary. Instead we’ll do one better and explain a HELOC without all the fancy jargon.

As a homeowner, you have a game-changing asset: your equity. But there’s a catch — equity isn’t exactly easy to exchange for the money it’s worth.

Enter the Home Equity Line of Credit. Your lender gives you a credit balance equal to part of your equity, and for approx. 10 years* you can spend it almost like you would a credit card. Most HELOCs have a standard variable rate, but keep your eyes peeled for fixed-rate options.

Similarities to a Credit Card

As you conduct your own research on HELOCs, you’ll probably hear people compare them to credit cards. At the most basic level, that’s true.

Both a HELOC and a credit card gives you a revolving credit limit. Every time you spend part of that money, the balance decreases. When you pay that money back, the available balance reverts to its previous amount. Just like a credit card, the funds are accessible on a card, and you can spend your HELOC money on almost anything you please.

Differences from a Credit Card

In most other ways, a HELOC is strikingly different from a credit card:

- Secured: A HELOC is a secured loan, which means it’s backed up by some sort of collateral (your house). If you default on your HELOC payments, your house could be at risk. A credit card, on the other hand, is unsecured.

- Lower interest rates: Because a HELOC uses your home as collateral, it’s less risky for lenders, which tends to equate to lower interest rates, often 5 to 10 percent less than a credit card.

- Higher loan amount: Credit card limits vary from person to person, but few people have a limit higher than their available equity. For that reason, most HELOC holders have access to more immediate funds than they would with a credit card.

The Right Way to Use a HELOC

Stick with us long enough and you’ll realize there’s rarely ever one right way to use any financial tool. But if there’s more than one right way, there’s twice as many wrong ways. Here’s how to tell the difference.

- DO calculate your estimated equity before applying.

- DON’T assume your interest rate will stay the same throughout the entire draw period.

- DO pay down past debts and build your credit to increase your chances of getting approved.

- DON’T spend your entire HELOC all at once.

- DO make both interest- and principal-based payments during the draw period.

- DON’T use your HELOC for nonessential or depreciating purchases.

- DO plan to repay your HELOC before selling your home.

- DON’T cancel your HELOC in the first few years without researching early-cancellation fees.

- DO consider other repayment options, like refinancing, and create a backup plan just in case.

Of course, we’re not about to tell you what to do without showing you why. For more context, check out our detailed explanations of the application process, draw period, and repayment period below.

(Already decided on a HELOC? Apply here.)

What to Expect: The Application Process

Before you do anything else, you need to set your expectations. It’s also worth noting that while other lenders may follow a similar model, we mostly reference ICCU’s application process here. The general steps will be the same for most lenders, but specifics (like processing times) vary.

What info and documents will I need to apply?

To apply, you’ll need to gather a few key documents. Anything that details your household income, mortgage and property information, and outstanding balances is fair game. That includes, but isn’t limited to:

- Social Security Number

- Property’s estimated value

- Property’s original purchase price and date

- Information on current and past liens

- Gross income

- Taxes and home insurance for all real estate owned

What happens after I submit a HELOC application?

Once you apply, a loan officer will verify your credit and property’s value. They’ll let you know if everything checks out within a few business days. After that (but before final approval), the loan officer will order a title report to document that you’re the home’s primary owner. Out of all the application steps, the title generally takes the longest — approx. 7 to 10 business days to order and receive a report.

Most ICCU HELOC applications take about three weeks to get fully approved. If your existing mortgage is through ICCU, it might be as quick as 10 days. If you have an existing lien on your home, it might take longer.

At the end of the approval process, you’ll get a three-day right of rescission. During that time, you can amend, finalize, or even withdraw your contract.

What to Expect: The Draw Period (Spending Your HELOC)

Fast forward through the application process and you’ll land in what’s arguably the most enjoyable phase of the entire HELOC: the draw period. During this 10-year timeframe, you can borrow (and spend) your funds as you please. As we mentioned before, you can spend your HELOC money on pretty much anything, just like you would a credit card.

Of course, just because you can doesn’t mean you should. Since you’re basically spending your home’s equity, it’s best to reserve your HELOC for important purchases, ideally ones that build your wealth in the long term.

What do most people use a HELOC for?

Though people spend HELOCs on all sorts of things, we’ve noticed a few overarching patterns. Most of our members use their credit lines for one of five reasons:

- Home renovations

- Debt consolidation

- College tuition

- A new car

- Medical expenses and other emergencies

How much of my HELOC can I spend?

You can spend as much or as little of the available balance as you like … but we recommend against spending it all at once.

For one, it’s a risky move if your financial situation changes. Remember, the draw period usually lasts 10 years. A full decade. We’re willing to bet you (and any other adult) will experience a few financial hiccups in that time. Imagine the stress you’d feel if, during one of those hiccups, you couldn’t make your monthly payments … which are directly backed by your house. Yeah. It’s about as bad as it sounds.

For another, withdrawing your entire balance can wreak havoc on your credit score. Lenders examine your credit utilization to ensure you aren’t relying too heavily on your credit. If you withdraw more than 30 percent of your total available credit (including existing loans and credit cards), your score could take a hit. On the flip side, you might increase your credit score by using your HELOC money responsibly and in moderation.

Do I have to make monthly payments?

The short answer is yes, you do.

Although the phase after the draw period is called the repayment period, you must make payments during both. You can make interest-only payments in the draw period, then pay off the principal balance (original loan amount) later. Because you’re waiting to pay the principal balance, you can expect lower minimum payments on a HELOC than other loans.

That principal balance comes due in the repayment period. If your HELOC features a balloon payment like ICCU, you’ll owe one final sum. If not, you’ll owe several smaller payments over a longer period of time.

Tip: When possible, make both interest- and principal-based payments during the draw period. That way you aren’t stuck paying off your entire principal balance in the repayment period.

What happens if I don’t spend any of my money?

Good news: If you don’t take money out of your HELOC, you don’t owe anything. In that way, simply holding a HELOC is relatively risk-free.

In fact, even if you withdraw some money, you only make payments on that portion, not the total balance. That’s true for the repayment period, too. You only owe the amount you spend.

Example: You spend $10K of your $50K HELOC. During the draw period, you only owe interest on the 10K, not the full $50K. If you spend just that 10K in the entire 10-year span, then you’ll need to pay back $10K (the principal) in the repayment period.

Can I cancel the HELOC partway through my contract?

Yes, but with limitations. Most lenders charge a fee for canceling your HELOC too early. Idaho Central Credit Union, for instance, applies a fee if you close your HELOC within the first three years. This varies by lender, though, so be sure to ask about cancellation fees when you apply.

What to Expect: The Repayment Period

The repayment period is exactly what it sounds like — the timeframe where you repay the rest of your loan. Though it always follows the draw period, its specific length and terms vary by lender. Some lenders give borrowers 10 years to pay off their HELOC, while others (like ICCU) require a one-time balloon payment after the draw period ends.

If you’re not careful, the repayment period will sneak up on you, but remember this: It is only as scary as you make it. Here are a few ways to ease the stress of those repayments.

How do I prepare for the repayment period?

It’s easy to ignore your owed principal until the repayment phase rolls around, but that should be your last resort. You can’t guarantee that you’ll be financially stable enough in 10 years to consistently repay that principal, particularly if you spent a good chunk of your HELOC.

That leaves you with two strategies: Use as little of your HELOC as possible or make both interest and principal payments during the draw period. We recommend a mix of both. Though you shouldn’t spend your HELOC frivolously, don’t be afraid to use it when you need extra funds — it’s there for a reason. When possible, pay down a bit of your interest and principal each month. If money gets tight once in a while, no worries. It won’t hurt to occasionally make the minimum payment … so long as you also make a habit of paying more when you can.

What happens if I can’t pay the money back?

The short answer: Worst comes to worst, your lender can foreclose your home.

The long answer: Remember how we said a HELOC uses your home as collateral? Well, lenders accomplish that by placing a lien on your home. It sounds scarier than it is. Technically any mortgage is also a lien. If you don’t pay your mortgage, you can lose your house.

A HELOC is often called a second mortgage because it operates the same way. The lender uses a lien to get the authority to claim your home … but only if you consistently default on your payments.

The lender doesn’t want to take your home, but they will if you force their hand. With that in mind, it’s best to avoid unnecessary risks. Only spend as much of your HELOC as you’re confident you can repay.

What is the best way to repay a HELOC?

Our best advice is also the most obvious (and applies to most forms of debt) — pay as much as you can when you can, in both the draw and repayment periods.

Of course, that’s easier said than done. If you find yourself in a tough situation, you have other options:

- Refinance to another HELOC

- Apply for a cash-out refinance

- Ask for a loan modification

All these alternatives require additional approvals, none of which are guaranteed, so don’t put all your eggs in one basket. Regardless of which strategy you choose, weigh the pros and cons of each before deciding.

How do I get started?

If you’re ready to take control of your equity, Idaho Central Credit Union is ready to help. Apply online, at a local branch. Or, if you want a face-to-face experience without leaving your home, call our Virtual Service Center. A VSC loan officer will review your application with you over a secure video chat line.

Not ready to take the leap yet? No problem. Give us a call to speak with a loan officer. They’ll answer your questions and help you decide if a HELOC is right for you. Though we at ICCU are personally big fans of HELOCs, we’ll only recommend one if we genuinely believe you’d benefit from it.

Disclosures

*10-Year Draw Period

Variable-rate APR will be updated monthly based on the index and margin associated with your plan. Rate will never be below 3.25% APR or above 24.00% APR. To view current APR, click here. Fees payable to third parties may be collected up front and may include borrower-requested appraisals or vesting changes via quit claim deed. Fees may range from $0 – $1,000. Property insurance required. Exact rate dependent on creditworthiness. Rates as of 06/29/2023.