What’s the first thing you think of when you hear the word “loan”? Chances are it isn’t the phrase “Home Equity Line of Credit.” On one hand, that’s more than fair — a HELOC, after all, isn’t exactly your run-of-the-mill traditional loan.

… And yet it’s arguably one of the most powerful.

In honor of that, we thought we’d share the most popular ways HELOCs are used, plus the best tactics to follow (and worst mistakes to avoid).

But first, what is a HELOC?

Don’t worry, a Home Equity Line of Credit isn’t as complicated as it sounds. At its core, a HELOC lets you borrow against your home’s equity, empowering you to make large purchases without putting everything on a credit card. For homeowners, HELOCs are a useful tool in a variety of situations, ranging from home renovations to debt consolidation and most things in between.

Equity Example: Your home is worth $200K but you only owe $150K. That means you have $50K in equity. Most of that equity, typically 80 percent, can be used in a HELOC.

When you use a HELOC, you can enjoy these benefits, among others:

- Easy access to your home’s equity

- Ability to make interest-only payments

- Flexibility to deposit and withdraw money without penalty

- Lower interest rate than a typical credit card

- Potential tax-deductible interest (depending on how you use the funds)

Those advantages are every bit as cool as they sound, but it’s vital that you weigh them against some of the disadvantages, too:

- Interest rate can change

- Home becomes collateral

- Home equity diminishes

- Easy to rack up an outstanding balance

[Read: HELOC Do’s and Don’ts: A Step-by-Step Guide to Home Equity Lines of Credit]

5 Ways to Use a HELOC: Pros and Cons

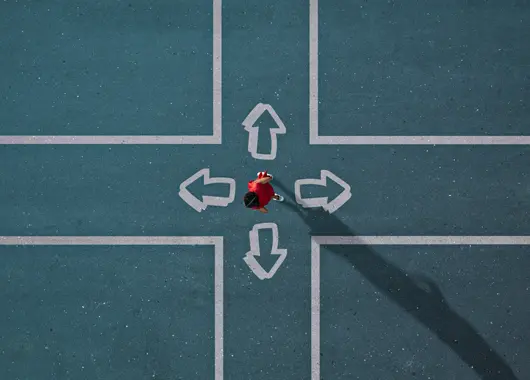

Okay, now for the fun part: spending. Since your available home equity is probably higher than your credit card limit, a HELOC gives you the chance to fund big goals and projects. Though a HELOC can be spent on practically anything, most HELOC transactions fall into one of five buckets — home renovations, tuition, vehicles, debt consolidation, and emergencies.

1. Home Renovations

A HELOC can transform your current home into your dream home. In fact, renovations are easily the most common HELOC purchase we see. Finish that basement, upgrade to granite countertops, replace your windows, you name it — a HELOC can help you tackle whatever project is on your list.

With a HELOC, your minimum payments are also interest-only, meaning your monthly payment could be much smaller than on a regular loan. That allows you to gain more control. You can choose which project you’d like to start first, pay the smaller payment while the project is underway, pay the rest off when you’re ready, and then move on to the next project easily — all with the same line of credit.

But keep one thing in mind: If you make interest-only payments throughout your entire loan, you’ll need to pay the entire principal at the end of your HELOC’s 10-year term. We recommend making both interest- and principal-based payments whenever possible.

2. Tuition

Whether you’re considering school for yourself or your kids, a HELOC might be an affordable way to do it. Avoid high-interest federal or private student loans and pay for tuition faster with a HELOC’s low interest rate. It also gives you the flexibility to pay for any additional college expenses that regular student loans may not offer.

Before deciding between a student loan and a HELOC, compare the pros and cons of each. Say, for instance, you go the HELOC route. (Remember, you only pay interest on the money you’re actively using.) Take just enough money to cover tuition and housing, then withdraw more later if needed. By customizing the timing of your withdrawals, you can wind up paying less total interest.

The opposite is true for a student loan. Because you receive the money in one lump sum, you pay interest on the entire amount — even if you don’t use all of it. That said, a student loan features a fixed rate, which tends to be much less stressful than a HELOC’s variable rate.

3. New Car

People often use a HELOC to buy a car when they (or the car) don’t qualify for an affordable auto loan. A car loan’s interest rate is determined by several factors, including the vehicle’s year, the loan’s length, and your credit score. While lenders still require a credit check before they give you a HELOC, they don’t take your car into consideration, which might help you save on interest.

Buying a car with a HELOC can be an effective short-term strategy, but it’s risky if you’re looking to build long-term wealth. If you think about it, you’re practically trading part of your home’s equity for that new car, which will inevitably depreciate. That’s not the end of the world if the car is relatively inexpensive, but as with any loan, you definitely want to compare the short-term and long-term benefits of both before making your decision.

4. Consolidate Debt

Most consumer loans have a higher interest rate than a HELOC. High rates can prolong the time it takes to pay off your debt … and you end up paying more in interest. By moving most of your debt to a HELOC, you have the chance to pay it down faster. It also equips you with flexible payments, which allows you to pay more when you are able and less when things are tight. Again, interest on a HELOC depends on the amount withdrawn; as you continue to pay down your HELOC, you pay less interest.

Be sure to only use as much of your HELOC as you feel comfortable paying off, though. HELOCs feature such low rates because they’re less risky for lenders — after all, your home is used as collateral. That means that if you default on your HELOC payments, you run the risk of losing your home.

5. Medical Expenses and Other Emergencies

There’s a difference between saving a little for a rainy day and financing a full-blown emergency. In fact, medical emergencies are the #1 cause of bankruptcies in the US.

Enter the HELOC. When your savings account falls short, a HELOC can pick up the slack. It tends to have a higher limit than a credit card, which helps you fund large, unexpected costs without skyrocketing your debt-to-income ratio. (The lower the better — aim for 30 percent or below.)

Plus, one of the best things about a HELOC is that the interest only accrues for the amount used. This means that if you have a HELOC already open but haven’t withdrawn anything, you don’t pay any interest at all. It can remain open and untouched until you need it. Then when you have an emergency, you get the advantage of a lower interest rate than what you’d typically find on a consumer loan or credit card.

Interest Example: You take out a $50K HELOC and only use $10K. Your interest only accrues on the $10K that you used, not the entire $50K line of credit.

You can’t get a HELOC in a day, though, so we suggest applying for one before an emergency hits you.

Interested in getting a HELOC of your own?

Not only can you do a variety of things with a HELOC, but HELOCs are a great and secure way to borrow responsibly. ICCU Home Equity Lines of Credit also offer many great features, including low interest, and flexible monthly payments. Check out our HELOC products and apply for yours today!